While the U.S. economy remains robust, inflation pressure continues, which could keep mortgage rates higher for longer.

Home sales ticked up slightly because of lower mortgage rates in January. However, inventory remains tight and the rate lock effect has been a key barrier to home sale volumes.

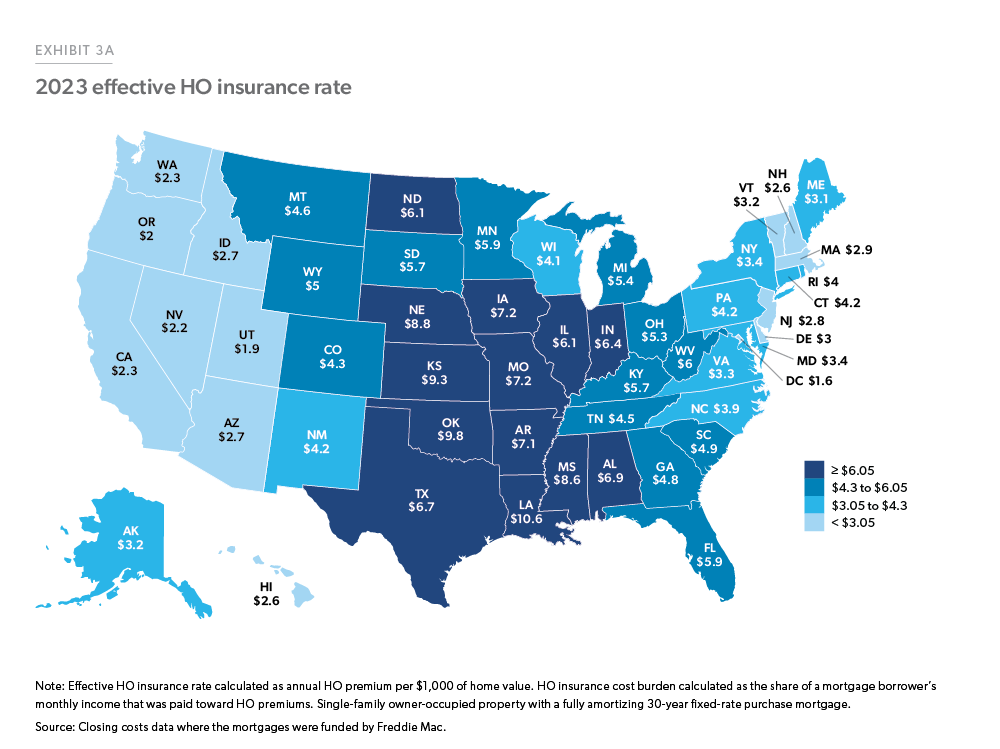

Homeowners’ insurance costs are growing but are a small fraction compared to the mortgage principal and interest payments.

Recent developments

U.S. economy: U.S. economic growth remained solid at 3.2% in Q4 2023 as per Bureau of Economic Analysis’ second estimate of GDP. While this is slightly lower than the Q3 growth of 4.9%, it remains above estimates of long-term potential growth. The slowdown in growth reflects a downturn in private inventory investment and federal government spending. However, consumption spending remained a key component in growth, contributing two percentage points to the overall growth.

To conclude, as a component of ongoing housing expenses, HO insurance costs are growing but are a small fraction compared to the mortgage principal and interest payment. However, even a small incremental increase in HO insurance cost will impact those at the margin. Our findings highlight substantial heterogeneity in such costs and the cost burdens experienced by borrowers. We find that the effective HO insurance rates were the highest in the central U.S., leading to notable cost burdens in several states within this region. Among all income groups, lower-income borrowers were more challenged. While the costs of HO insurance remain a small fraction of housing expenses, it’s a trend that we will continue to track going forward.

https://www.freddiemac.com/research/forecast/20240320-us-economy-remains-robust

https://www.freddiemac.com/research/forecast/20240320-us-economy-remains-robust

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link